Budget 2026 Decoded: What the Headlines Didn’t Tell the Common Man

Failed to add items

Add to basket failed.

Add to wishlist failed.

Remove from wishlist failed.

Adding to library failed

Follow podcast failed

Unfollow podcast failed

-

Narrated by:

-

By:

About this listen

Are you truly benefiting from the "Reform Express"?

In today’s episode of Between the Lines, we strip away the technical jargon of the Union Budget 2026-27 to reveal the hidden wisdom that impacts your daily life.

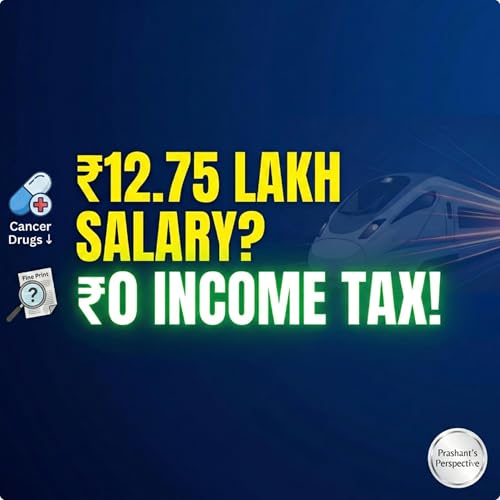

We deep-dive into the brand-new Income Tax Act 2025, explaining how a simple "nil-tax" dream for salaries up to ₹12.75 lakh is becoming a reality. But it’s not just about the numbers in your bank account.

We explore the human side of the budget—from life-saving relief on cancer medications to the "time dividend" coming your way through the Mumbai-Pune high-speed rail.

Whether you are a young professional, a small business owner, or a conservative saver, this minimalist narrative connects the dots between government policy and your kitchen table.

Uncover the wisdom. Read between the lines.

👉 Subscribe to the Prashant’s Perspective channel for more deep dives into the hidden truths behind the headlines.

Tags

#UnionBudget2026 #CommonManPerspective #IncomeTaxAct2025 #ViksitBharat #PersonalFinanceIndia #TaxPlanning #PuneInfrastructure #HealthcareAffordability #PrashantsPerspective #IndianEconomy #BetweenTheLines #HiddenWisdom #FinancialFreedom

Disclaimer

This podcast is produced exclusively for educational and informational purposes and does not constitute professional financial, legal, or investment advice. The insights provided are based on the Union Budget 2026-27 speech and the New Income Tax Act 2025; however, listeners should note that specific administrative rules and perquisite valuation frameworks are subject to official notification by the government. We do not assume any liability for actions taken based on this content. Please verify all tax slabs, interest rates, and policy details with official government gazettes or consult a certified tax professional before making any financial decisions.